Hundreds of households still had not filed their Local Property Tax (LPT) early on Friday morning, and while the numbers filing ramped up overnight many look set to miss the midnight deadline.

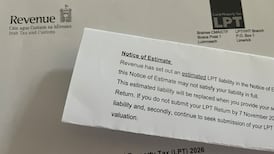

Revenue has contacted homeowners with an “estimated” new valuation band that will be applied to their property.

However, everyone is still obliged to submit their own valuation before midnight on Friday.

These valuations, setting out what the properties were worth last Saturday, November 1st, will determine how much local property tax households will pay each year between 2026 and the end of 2030.

READ MORE

Anyone who has not filed ahead of the deadline risks being pursued and they could face financial penalties for late returns.

Until Revenue gets a valuation from a homeowner, it will work off the estimate but it will “continue to seek submission of your LPT return and confirmation from you of your property valuation”.

It has made it clear that “regardless of whether you accept the estimate, or you determine that it should change based on your own self-assessed valuation of your property, you are required to submit an LPT return”.

According to the latest figures released on Friday morning, more than 1.3 million homeowners - including councils on behalf of council properties - have filed updated details, with a total of 78,418 returns lodged on Thursday.

[ Local property tax: How does it work and what happens if you miss the deadline?Opens in new window ]

Close to 12,000 returns were filed early on Friday morning but many hundreds of thousands of people look set to miss the midnight deadline unless the numbers filing increases dramatically over the course of the day.

“As is the case with all significant filing deadlines, we are seeing increased activity within the LPT portal as we approach the filing deadline,” a Revenue spokeswoman said.

She noted that the number of returns filed to date has almost doubled since last Wednesday. “We expect daily filing rates to increase over the remainder of this week and we will continue to monitor the functionality of the LPT system during this time,” the spokeswoman added.

Alongside increased filing activity, Revenue has also seen an increase in the level of contact being made through its telephone helpline and myEnquiries facility.

“Our telephone helpline is incredibly busy, and we are answering approximately 5,500 calls a day.”

LPT is due on more than 2.2 million properties with around 1.5 million homeowners expected to pay the tax.

The tax bill will range from €95 for those in the lowest band to €3,110 for homes worth between €1.995 million to 2.1 million. If your home is worth more than €2.1 million, you’ll pay 0.3 per cent of any value above that level.

For most people, an increase in the value of their properties since the last revaluation date in 2021 means they will face only a modest increase in their LPT charge.

Wider valuation bands and a tax “rate” that is now just half what it was up to 2022 means there are unlikely to be any significant surprises for homeowners, despite a near 30 per cent average climb in the cost of homes since the last re-valuation took place in 2021.